Here's the website URL: https://onlinetitleloans.co/. If you're seeking brief money relief, on the net title loans give a hassle-free Alternative. These loans assist you to leverage your automobile's title to protected funds swiftly, often without the stringent credit history checks related to regular financial loans. No matter if you're in Texas, Wisconsin, or Tennessee, comprehension the nuances of title financial loans will help you make knowledgeable selections.

Exactly what are Title Financial loans?

Title loans are secured loans in which borrowers use their car or truck's title as collateral. The personal loan quantity is usually determined by a proportion with the auto's value. In contrast to standard loans, title loans typically have a lot less stringent credit history prerequisites, making them accessible to individuals with much less-than-ideal credit score histories.

Benefits of Online Title Financial loans

Brief Acceptance and Funding: On-line title financial loans normally deliver swift approval processes, with a few lenders presenting similar-day funding. Keep the Car or truck: Borrowers can keep on to utilize their automobiles while repaying the personal loan, assuming that they satisfy the repayment conditions. Small Credit rating Checks: Many on line title bank loan providers concentration a lot more on the car or truck's value when compared to the borrower's credit score rating. Benefit: The applying method is often simple and might be completed through the comfort of your property.

Title Loans in Texas

Texas citizens trying to get title loans can gain from the point out's fairly lenient rules. In keeping with OnlineTitleLoans.co, Texas title loans supply:

Adaptable Loan Amounts: Financial loan quantities change based on the automobile's worth, with some lenders giving nearly $five,000. Fast Processing: Quite a few lenders supply exact same-day funding on acceptance. - Minimum Documentation: Standard requirements frequently contain a clear car title, proof of income, and a valid ID.

Title Financial loans in Wisconsin

Wisconsin inhabitants might also entry on the web title loans. Although certain terms may change, popular options include things like:

On the web Programs: Your entire application procedure can normally be concluded on the internet.- Brief Choices: Lots of lenders give fast acceptance choices.

Motor vehicle Inspection: Some lenders may perhaps need a car or truck inspection to determine its price.

Title Financial loans in Tennessee

Tennessee delivers title financial loans with certain polices. As famous by TFC Title Loans, Tennessee title financial loans offer:

Quick Entry to Hard cash: Perfect for emergencies, title financial loans in Tennessee offer rapid funding, often in 24 several hours. Effortless Qualification: Approval relies on the value of your respective vehicle, not greatly on your own credit history rating.Retain Motor vehicle Use: You are able to keep on utilizing your auto while repaying the mortgage, offered you meet up with your payment obligations.

Tips on how to Make an application for an on-line Title Mortgage

Making use of for an internet based title personal loan ordinarily involves the subsequent ways:

Entire an Online Software: Present particular and car or truck data via a protected on the web kind. Submit Demanded Paperwork: Upload vital paperwork such as the vehicle's title, evidence of revenue, and identification.Vehicle Inspection: Some lenders may possibly require a Picture or in-particular person inspection from the auto. Assessment Personal loan Phrases: Thoroughly go through and understand the financial loan agreement, together with curiosity fees and repayment phrases. Obtain Cash: On acceptance, money are usually disbursed via direct deposit or Look at.

Factors Right before Using Out a Title Financial loan

- Curiosity Premiums: Title loans typically have greater curiosity rates in comparison to regular financial loans.

- Repayment Terms: Ensure you can meet up with the repayment program to avoid prospective motor vehicle repossession.

Personal loan Amount: Borrow only what you will need and may manage to repay. Lender Reputation: Analysis and pick reliable lenders with transparent terms.

Options to Title Loans

If you're hesitant about taking out a title personal loan, consider these alternatives:

Own Financial loans: Unsecured loans that do not call for collateral. Credit Cards: If you have out there credit rating, this can be a brief-phrase Answer.- Payday Choice Loans (Friends): Offered by some credit history unions with decrease charges and rates.

Borrowing from Loved ones or Friends: Whilst likely unpleasant, This may be a no-interest solution.

Conclusion

On the web title financial loans is usually a practical choice for people in Texas, Wisconsin, and Tennessee seeking swift usage of income. Having said that, It is important to know the phrases, fascination title loans texas rates, and likely threats involved. Often make sure you can fulfill the repayment conditions to avoid dropping your motor vehicle. For more info or to use, go to OnlineTitleLoans.co.

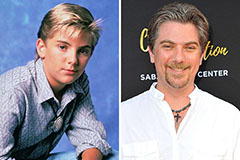

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!