Here is the website URL: OnlineTitleLoans.co. This System provides a streamlined course of action for acquiring

Knowing Title Financial loans

Title loans are secured loans in which borrowers use their auto's title as collateral. Because of this the lender retains the title to your automobile while you retain possession and use on the motor vehicle. These financial loans are notably helpful for people who may well not have usage of conventional credit score avenues but possess a auto of value.

Swift Use of Resources: Title financial loans often offer speedy approval and funding, often in the similar working day. Minimal Credit Specifications: Because the mortgage is secured by your car, credit score checks could be significantly less stringent. Continued Vehicle Use: Borrowers can continue driving their car in the personal loan expression.

How On the web Title Loans Work

Implementing for the

Application Submission: Present particulars about you along with your vehicle by way of an internet sort. Documentation Critique: Post necessary paperwork, which include your automobile's title, evidence of income, and identification.Acceptance Procedure: Lenders assess your application and establish the personal loan quantity based upon your vehicle's worth. Acquiring Resources: Upon approval, money are disbursed, generally by using direct deposit or Verify. Repayment Phrases: Repay the personal loan as agreed, keeping in mind the interest prices and fees connected.

Title Loans in Texas

Texas citizens in search of

Title Loans in Wisconsin

In Wisconsin, getting a

Title Loans in Tennessee

Tennessee citizens keen on tennessee title loans can take a look at numerous possibilities that cater for their unique demands. Lenders in Tennessee may well offer loans according to the value on the borrower's car or truck, with conditions that allow for ongoing usage of the vehicle. Just like other states, It is really crucial to evaluation the bank loan terms very carefully and guarantee you can meet up with the repayment obligations.

Advantages of On the web Title Loans

Choosing a web-based title mortgage provides a number of benefits:

- Convenience: Utilize from any place without the require to go to a Bodily area.

Velocity: Rapid approval and funding procedures. Accessibility: Accessible to people today with many credit rating histories, supplied they have a qualifying car or truck.

Factors Prior to Implementing

Just before continuing using a title loan, look at the following:

Curiosity Fees: Title financial loans can have better interest costs in comparison to regular loans. Repayment Conditions: Ensure you can fulfill the repayment routine to stop possible repossession of the auto. Bank loan Amount of money: Borrow only what you may need and will afford to repay.

Conclusion

Title loans can be quite a practical solution for all those needing swift dollars, specially when traditional credit avenues are unavailable. By knowing the method and thoroughly thinking of the conditions, you can make an educated selection that aligns using your money desires. For title loand wisconsin more info and to use, take a look at OnlineTitleLoans.co.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Luke Perry Then & Now!

Luke Perry Then & Now! Daniel Stern Then & Now!

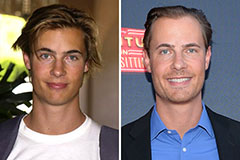

Daniel Stern Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!