Here is the website URL: OnlineTitleLoans.co. This System provides a streamlined method for acquiring

Knowing Title Financial loans

- Speedy Use of Funds: Title loans usually deliver speedy approval and funding, in some cases within the exact same day.

Nominal Credit rating Necessities: Considering that the loan is secured by your vehicle, credit checks might be significantly less stringent. Continued Car Use: Borrowers can carry on driving their vehicle through the mortgage term.

How On the internet Title Loans Work

Implementing for the

- Software Submission: Deliver information about your self and also your motor vehicle by means of an on-line type.

Documentation Overview: Submit vital documents, for instance your car's title, evidence of income, and identification.Acceptance Process: Lenders evaluate your software and figure out the financial loan amount depending on your auto's value. Obtaining Cash: Upon approval, money are disbursed, generally by using immediate deposit or Verify.Repayment Conditions: Repay the mortgage as agreed, retaining in mind the fascination premiums and costs involved.

Title Financial loans in Texas

Texas people seeking

Title Financial loans in Wisconsin

In Wisconsin, obtaining a

Title Financial loans in Tennessee

Tennessee residents enthusiastic about

Advantages of On the internet Title Loans

Opting for an internet title loan offers numerous advantages:

Convenience: Utilize from any where with no want to visit a Actual physical site. Speed: Brief acceptance and funding processes. Accessibility: Available to individuals with many credit rating histories, supplied they own a qualifying car or truck.

Issues Just before Implementing

Ahead of proceeding that has a title mortgage, consider the next:

- Fascination Rates: Title loans may have bigger curiosity fees in comparison with traditional loans.

Repayment Terms: Make sure you can meet the repayment timetable to stay away from prospective repossession within your car or truck. Bank loan Amount of money: Borrow only what you may need and will afford to repay.

Conclusion

Title loans can be quite a practical Alternative for title loans those needing swift dollars, specially when traditional credit avenues are unavailable. By knowing the method and thoroughly thinking of the conditions, you can also make an educated final decision that aligns with your financial needs. For more information and to apply, visit OnlineTitleLoans.co.

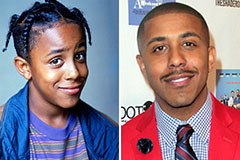

Marques Houston Then & Now!

Marques Houston Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Kane Then & Now!

Kane Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!