Here is the web site URL: OnlineTitleLoans.co. This System offers a streamlined approach for obtaining title financial loans on-line, catering to people in several states, which include Texas, Wisconsin, and Tennessee. Whether you might be going through sudden fees or in search of quick dollars, comprehension the nuances of title financial loans can empower you to generate educated economic conclusions.

Knowledge Title Loans

- Rapid Use of Cash: Title financial loans often offer speedy approval and funding, from time to time throughout the exact day.

Small Credit history Prerequisites: Since the loan is secured by your vehicle, credit checks might be much less stringent.Ongoing Auto Use: Borrowers can keep on driving their auto in the course of the mortgage term.

How Online Title Financial loans Get the job done

Making use of to get a title personal loan on the net simplifies the method, enabling you to complete the applying from your ease and comfort of your private home. Here is a common overview of your methods involved:

Application Submission: Deliver aspects about by yourself as well as your car or truck by means of an online kind.- Documentation Critique: Submit vital paperwork, which include your automobile's title, proof of revenue, and identification.

Approval Approach: Lenders assess your application and ascertain the loan volume dependant on your car's price.Receiving Funds: Upon acceptance, cash are disbursed, normally via direct deposit or Examine. Repayment Terms: Repay the bank loan as agreed, preserving in your mind the desire fees and costs affiliated.

Title Loans in Texas

Texas residents looking for

Title Financial loans in Wisconsin

In Wisconsin, acquiring a title financial loan Wisconsin is straightforward, with quite a few lenders offering on line apps. The loan total is typically based on the automobile's benefit, and borrowers can typically continue working with their automobile during the financial loan period. It truly is advisable to compare unique lenders to find the very best costs and phrases that go well with your financial scenario.

Title Loans in Tennessee

Tennessee inhabitants thinking about

Advantages of On the web Title Financial loans

Deciding on a web based title financial loan delivers many rewards:

Ease: Apply from anywhere without the need to have to go to a physical area. Velocity: Quick approval and funding processes.Accessibility: Available to persons with numerous credit rating histories, offered they possess a qualifying car or truck.

Considerations Ahead of Making use of

In advance of continuing that has a title financial loan, think about the following:

Interest Fees: Title financial loans may have larger interest rates in comparison with standard financial loans.Repayment Phrases: Make sure you can meet the repayment timetable to avoid probable repossession within your automobile. Mortgage Amount of money: Borrow only what you require and might afford to pay for to repay.

Conclusion

Title loans can be quite a practical solution for all those in need of brief dollars, particularly when standard credit avenues are unavailable. By comprehending the procedure and thoroughly taking into consideration the terms, you may make an informed decision that aligns together with title loans your financial needs. For more info and to apply, go to OnlineTitleLoans.co.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Jonathan Lipnicki Then & Now!

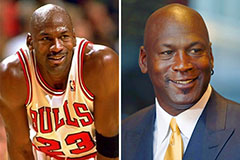

Jonathan Lipnicki Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Shane West Then & Now!

Shane West Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now!